Antwort Are credit spreads more profitable than debit spreads? Weitere Antworten – Are debit spreads more profitable than credit spreads

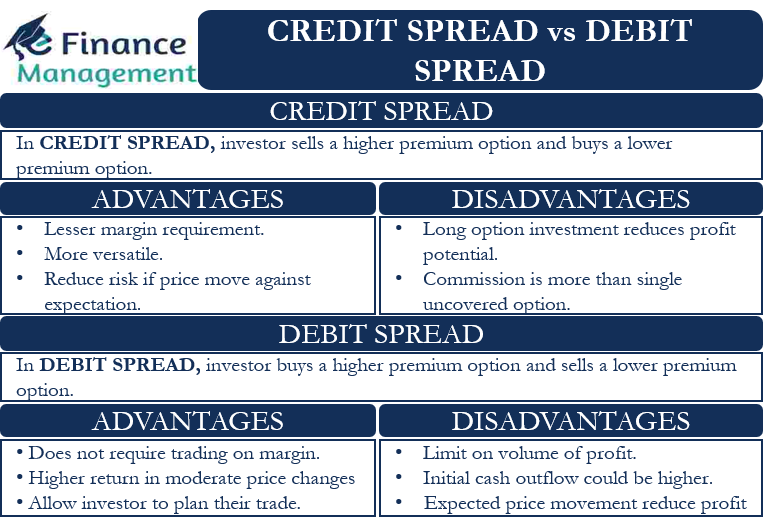

If you are looking to limit risk and have a limited budget, debit spreads may be the better option. However, if you are looking for higher profit potential and have a larger budget, credit spreads may be the better choice. For example, let's say you are bullish on a stock and want to limit your risk.Debit spreads can cut the risk if the trader knows the price will move in a specific direction. Credit spreads, though, can help traders manage risk because they can limit the amount of potential profit. They can be used when traders aren't sure of where the price for the underlying asset will move.Exiting a Bull Call Debit Spread

If the spread is sold for more than it was purchased, a profit will be realized. If the stock price is above the short call option at expiration, the two contracts will offset, and the position will be closed for a full profit.

Are debit spreads risky : Call debit spreads have a defined risk, like other spreads, as well as a defined profit potential. For bullish trades, we buy call debit spreads, which means we pay (a debit) to open the trade. To close a call debit spread, we sell it to close the trade (ideally for more than we paid for the spread).

Why credit spreads are better than debit spreads

Debit spreads typically have positive vega and benefit when IV rises over time. All else being equal, an increase in IV could provide the opportunity to sell the spread for more than the debit. By contrast, credit spreads typically have negative vega and benefit when IV falls over time.

Is selling credit spreads profitable : Credit spreads produce limited profit potential but limit your risk. Your profit will be the difference between the 2 options premiums. How Far Out Should I Sell Credit Spreads Typically, you'll want to have a sell day 2-3 weeks after the date of purchase.

In essence, you can make a living trading credit spreads. But not every month will be profitable. So keep that in mind if you're looking to just trade spreads for a living.

Debit spreads typically have positive vega and benefit when IV rises over time. All else being equal, an increase in IV could provide the opportunity to sell the spread for more than the debit. By contrast, credit spreads typically have negative vega and benefit when IV falls over time.

What is better credit or debit spreads

Debit spreads typically have positive vega and benefit when IV rises over time. All else being equal, an increase in IV could provide the opportunity to sell the spread for more than the debit. By contrast, credit spreads typically have negative vega and benefit when IV falls over time.Disadvantages: The profit potential is capped. The most you can make is the difference between the two strike prices minus the net debit.Debit spreads typically have positive vega and benefit when IV rises over time. All else being equal, an increase in IV could provide the opportunity to sell the spread for more than the debit. By contrast, credit spreads typically have negative vega and benefit when IV falls over time.

Limited Profit Potential: Just as losses are limited, so are profits. The maximum profit in a credit spread is capped, which means that potential gains may be less than those of other strategies. Market Moves Against You: If the underlying asset's price moves against your position, you can incur losses.

Can you make money with credit spreads : When you establish a bullish position using a credit put spread, the premium you pay for the option purchased is lower than the premium you receive from the option sold. As a result, you still generate income when the position is established, but less than you would with an uncovered position.

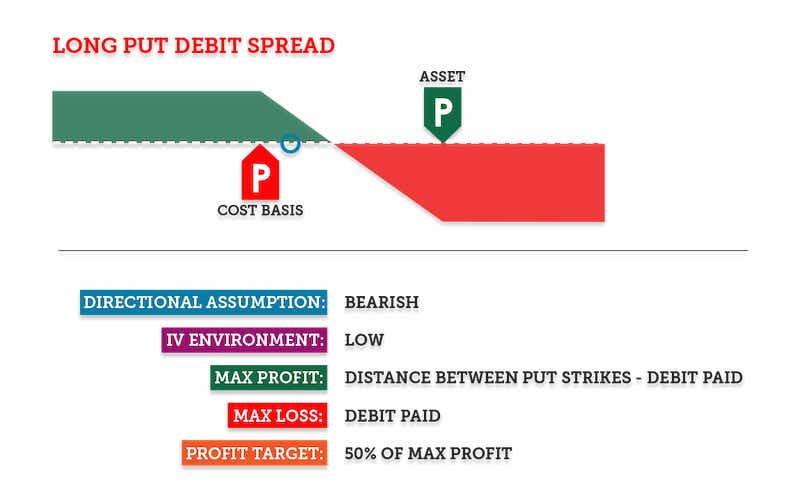

What is the max profit of a debit spread : The maximum potential profit of a debit spread is equal to the width of the strikes minus the debit paid. The maximum loss potential of a debit spread is equal to the debit paid.

Can you lose money on a credit spread

As with any investment strategy, there is risk and the possibility that you could lose money. On a credit spread, you could lose money if the premiums received are less than the premiums paid.

Avoid Debt

A debit card draws on money that the user already has, eliminating the danger of racking up debt. People typically spend more when using plastic than if they were paying cash. 4 By using debit cards, impulsive spenders can avoid the temptation of credit and stick to their budget.Since you can't spend more than you have, debit cards can also be a helpful way to build strong spending habits. If knowing you can carry a balance on a credit card will make you more likely to overspend, you may be better off using a debit card vs. using a credit card.

Which is better debit or credit spreads : Debit spreads typically have positive vega and benefit when IV rises over time. All else being equal, an increase in IV could provide the opportunity to sell the spread for more than the debit. By contrast, credit spreads typically have negative vega and benefit when IV falls over time.

:max_bytes(150000):strip_icc()/dotdash_Final_Which_Vertical_Option_Spread_Should_You_Use_Sep_2020-02-e39443c065bb471fb4d69e6cb58f19dc.jpg)