Antwort How do I get a Tax ID number in Germany? Weitere Antworten – How can I get tax ID number in Germany

The tax office will send you the tax ID to your registered German address within 2-3 weeks of your residence registration; often even within one week. If you do not receive the tax ID within those 3 weeks or you have lost the one you had, you can request a duplicate from the Finanzamt.You get the tax number in Germany when you submit a tax return in that city for the first time or apply for it. You get your tax identification number at birth or when you register in Germany. It indicates which tax office is responsible for you.The tax office responsible for you is determined by where you live. If you change your address, your competent tax office will change as well. You can find your closest Finanzamt by entering your postcode into the Finanzamt24 website.

What is the tax ID number for students in Germany : The tax number is created after your registration at the Bürgeramt. This happens automatically, you do not have to apply for it separately. About six to eight weeks after your registration you will receive a letter with your tax identification number.

How do I get a Sozialversicherungsnummer in Germany

You get a Sozialversicherungsnummer automatically after you apply for public health insurance. You will get it by post. You do not get a Sozialversicherungsnummer automatically. You must contact the Deutsche Rentenversicherung and ask for it.

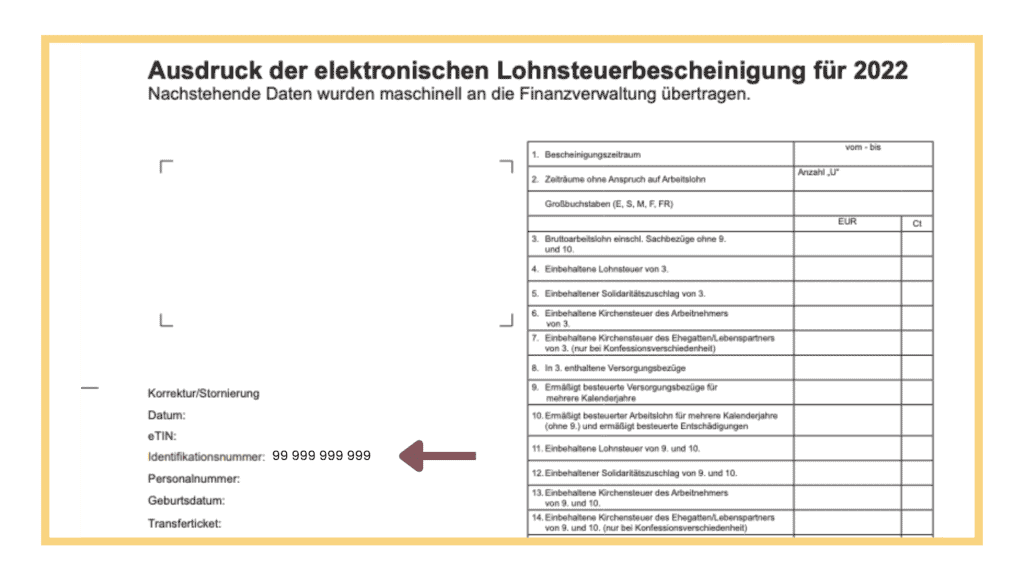

Is tax ID and Social Security number the same in Germany : It's important to note that your social security number is distinct from your tax ID (“Steuernummer”). The tax ID consists of 11 digits and is issued by the German tax office.

This number is required by your employer to pay your salary and to calculate the amount of tax you need to pay. If you do not have a tax ID you will be charged the maximum rate of tax until you get one.

Rest assured, there are all different words for the same thing. Your social security number is distinctly different from your tax ID (Steueridentifikationsnummer), an 11-digit number used by the tax office.

Can I get my tax number online Germany

As a citizen in Germany, you automatically receive a tax identification number. You can request a new one online if you lose it.A value-added tax identification number is a unique identification number that businesses are given by Germany's Federal Central Tax Office (BZSt) in addition to their tax number.This number is normally issued by the Federal Tax Office (Bundeszentralamt für Steueren – BZSt) shortly after a child is born and registered at the local Registry Office (Einwohnermeldeamt) in Germany. In the case of immigrant children, the number is assigned when the child is registered at the Einwohnermeldeamt.

Students aren't usually obligated to submit a tax return. However, if you work alongside your studies, you may need to do so, and could get money back from the tax office.

Is tax ID and social security number the same in Germany : It's important to note that your social security number is distinct from your tax ID (“Steuernummer”). The tax ID consists of 11 digits and is issued by the German tax office.

Where can I find my Sozialversicherungsausweis : After your employer has registered you, you should receive your official letter from the German pension fund, including your Sozialversicherungsausweis (social security card), with your insurance number. This usually takes between 4 to 6 weeks and is delivered to your German address.

What is a tax ID for expats in Germany

If you are a non-resident and need a Tax ID for tax purposes, you need to contact your responsible tax office. They will apply the the IdNr and send it to you.

If you have a TK public health insurance via Expatrio TK will send you your social security number after you arrive in Germany and activate the insurance. If you have a private health insurance (like our partner, DR-WALTER) you need to get your social security number directly from your local Rentenversicherung office.To apply for a bank account in Germany, you need the following documents: Your ID card or passport. Proof of address registration or Meldebescheinigung (a registration certificate you must get within 14 days of living at your new address in Germany) German tax ID number.

What happens if you don’t file taxes in Germany : The late charge (Verspätungszuschlag) amounts to 0.25% of the income tax to be paid and at least 25 euros per month! If you still do not complete your tax return, the Tax Office can, in addition, apply penalty payments (Zwangsgeld) as a punishment.