Antwort How safe is my money in Barclays Bank? Weitere Antworten – Is my money safe with Barclays Bank

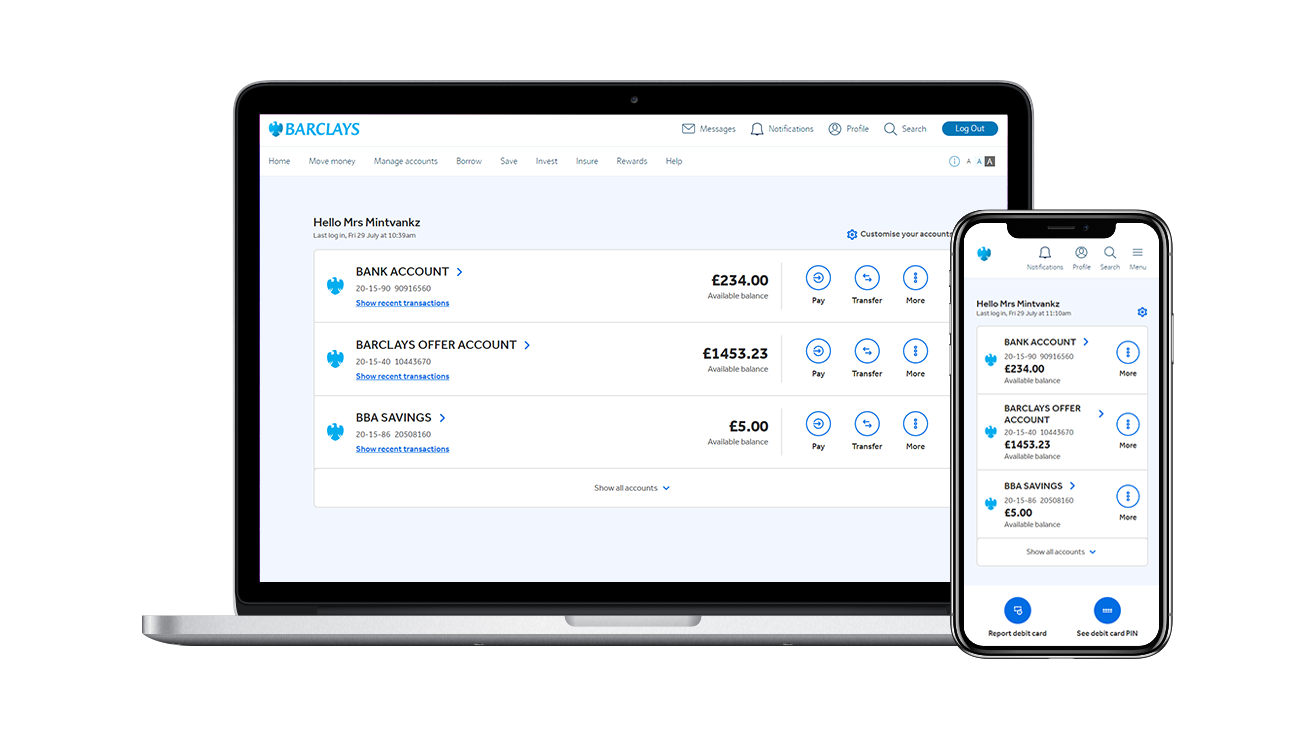

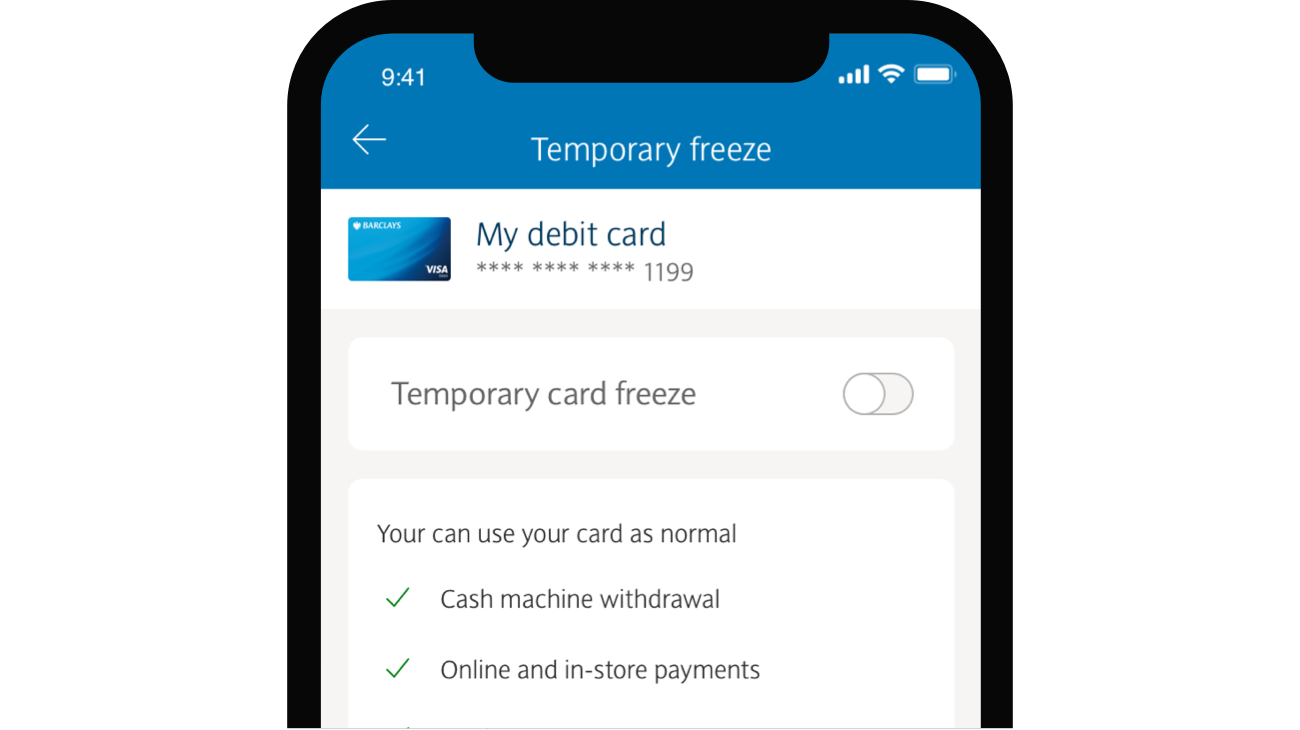

When you use our Online Banking services or the Barclays app, you're protected by our guarantee. This means that if you tell us a payment from your account wasn't authorised and ask us for a refund, we'll reverse the transaction as soon as we can – though there are some exceptions to this.Your eligible deposits with Barclays Bank UK PLC are protected up to a total of £85,000 by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme.Fitch Affirms Barclays at 'A'; Outlook Stable

Fitch has also affirmed the Long-Term IDRs of Barclays' subsidiaries, Barclays Bank plc (BBplc) and Barclays Bank UK PLC (BBUK), at 'A+' and their VRs at 'a'. The Long-Term IDRs of Barclays Bank Ireland plc (BBI) and Barclays Capital Inc. (BCI) have been affirmed at 'A+'.

Is Barclays a trustworthy bank : Barclays is best for those seeking high-yield savings accounts or competitive certificate of deposit (CD) rates. Consumers who need other types of banking services such as checking — or even quick access to deposit funds — should look elsewhere.

Which UK bank has best security

Starling Bank and HSBC performed well

research on online banking security carried out last year saw HSBC receive the highest score. The UK bank had similar success in the most recent report; scoring 80 per cent for online banking. HSBC also received the highest banking app score with 82 per cent.

Which UK bank is safest : If you're looking to 100% guarantee of your savings, the only bank able to offer that is NS&I. That's because it's part of the government and backed by HM Treasury, meaning every penny of your savings is protected, not just the FSCS limit.

Current credit ratings

| Credit Ratings | Barclays PLC | Barclays Bank PLC |

|---|---|---|

| Issuer Rating | A / Stable | A+ / Stable |

Barclays Bank's heavy reliance on investment banking activities poses a weakness. The bank's investment banking division, Barclays Capital, has experienced fluctuations in profits due to market volatility, as seen during the global credit crunch.

Where is the safest place to keep your money UK

National Savings and Investments (NS&I) are the range of savings accounts offered to savers by the government. They are one of the safest ways to save your money. If you do want to open an account with National Savings and Investments, think about how long you want to invest for.Summary: Safest Banks In The U.S. Of April 2024

| Bank | Forbes Advisor Rating | Products |

|---|---|---|

| Chase Bank | 5.0 | Checking, Savings, CDs |

| Bank of America | 4.2 | Checking, Savings, CDs |

| Wells Fargo Bank | 4.0 | Savings, checking, money market accounts, CDs |

| Citi® | 4.0 | Checking, savings, CDs |

Your eligible deposits with Barclays Bank UK PLC are protected up to a total of £85,000 by the FSCS – the UK's deposit guarantee scheme.

Customers of these banks are most likely to be a victim of fraud

| Ranking | Bank | Fraud Search Volume |

|---|---|---|

| 1 | Santander | 11,690 |

| 2 | NatWest | 11,480 |

| 3 | Barclays | 9,450 |

| 4 | HSBC | 5,540 |

Which is the strongest UK bank : HSBC Holdings

HSBC Holdings has been deemed the seventh-largest bank globally and the largest in Europe in holding total assets. Although it was founded in Hong Kong in March 1865, it currently has its headquarters in the financial capital of the United Kingdom, London, and is the largest bank in the United Kingdom.

What is Barclays risk : Barclays is a global force in banking, and Risk at Barclays is involved in every single transaction, every product, every service and every decision Barclays makes across the full suite of transatlantic banking operations.

How much money is safe in UK banks

Bank and building societies

If you hold money with a UK-authorised bank, building society or credit union that fails, we'll automatically compensate you. up to £85,000 per eligible person, per bank, building society or credit union. up to £170,000 for joint accounts.

Wells Fargo (WFC)

A member of the big four bank stocks, Wells Fargo (NYSE:WFC) in recent years courted some ugly controversies. Nevertheless, it finds itself as one of the least likely financial institutions to fail.UK banks remain strong enough to support households and businesses – even if future economic conditions are worse than we expect.

Could Barclays Bank go bust : Barclays PLC's odds of distress is less than 4% at this time. It is unlikely to undergo any financial crunch in the next 24 months.