Antwort What are terms of payment? Weitere Antworten – What is payment terms

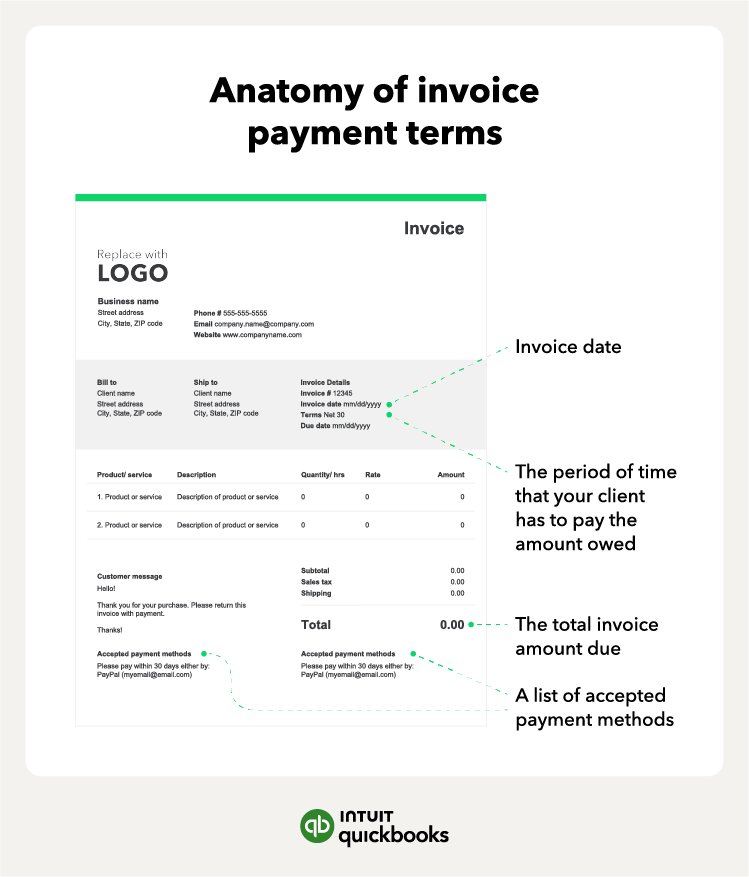

Payment terms are the conditions surrounding the payment part of a sale, typically specified by the seller to the buyer. Do you need to include payment terms on your invoices It's easy to add them and stay on top of late payments with online invoicing software like SumUp Invoices.Contract payment terms refer to the specific terms and conditions under which parties pay and get paid. These terms outline how and when payment will be made for goods delivered, services rendered, or work performed.What does the payment term "30% deposit, 70% before shipment" mean This is a common payment term in international trade where the buyer pays 30% of the total order value upfront as a deposit. The remaining 70% is paid before the goods are shipped out from the supplier's location.

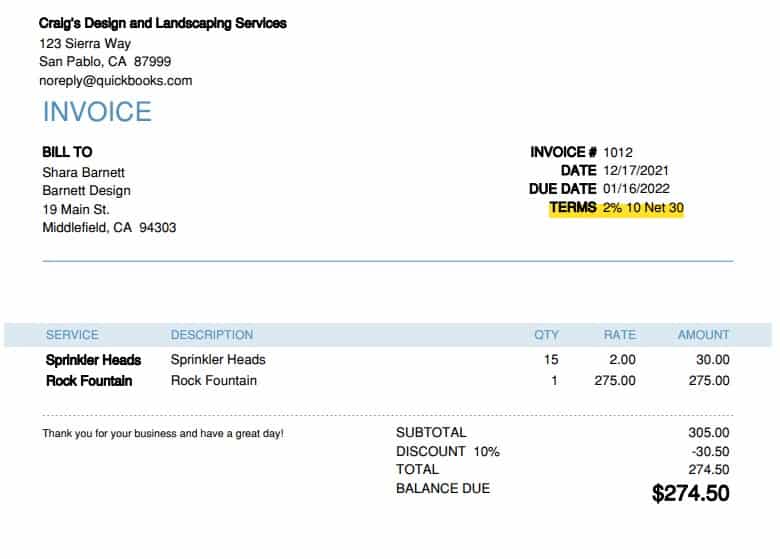

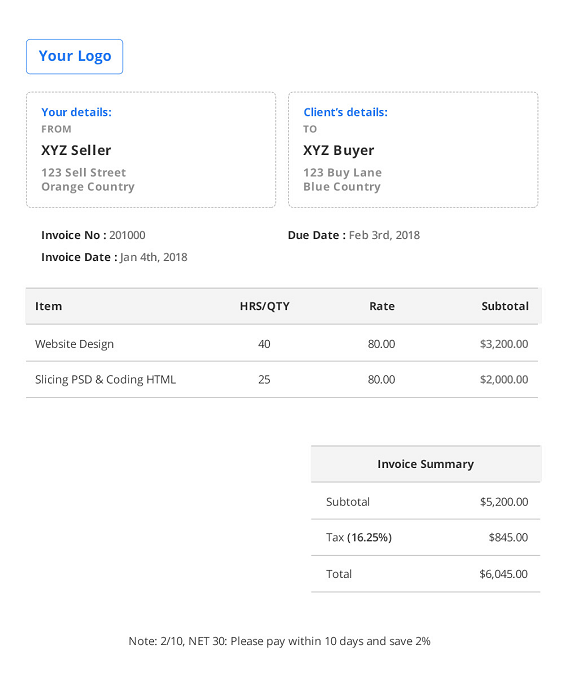

How do you write 30 days payment terms : For example, if you want them to pay within 30 days, they have a “Net 30” which means the invoice is due 30 days after it is sent out.

What are the five payment term

There are five primary methods of payment in international trade that range from most to least secure: cash in advance, letter of credit, documentary collection or draft, open account and consignment.

How do I choose payment terms :

- 1 Industry standards. Before you set your own payment terms, you should research the industry standards and norms for your sector.

- 2 Customer type. Another factor to consider when choosing your payment terms is the type of customer you are dealing with.

- 3 Cash flow needs.

- 4 Legal rights.

- 5 Here's what else to consider.

Net 7, 10, 30, 60, 90 – Net payment terms show that the payment is due the specified number of days after the invoice date of issue.

Term Definition

This means you expect payment immediately when the client receives your invoice. Payment is due seven days from the invoice date.

What is a 30 60 90 payment term

Net 30-60-90 day terms is a simple way of offering a business a payment plan. They pay one third of the invoice in 30 days, another third of the invoice in 60 days, and the final third of the invoice in 90 days.This means that the net payment is due in either 30, 60, or 90 days after the invoice date. For example, if the invoice was dated September 10 and you used one of the most used payment terms, net 30, then the payment would be expected before September 9.State When Payment is Due: For example, 'Payment due within 30 days from the invoice date. ' Late Payment Penalties: If you impose interest or penalties for late payments, this should be clearly stated. Discounts: If you offer early payment discounts, include the details.

Net terms dictate how long a customer has to remit payment upon receipt of an invoice. For instance, net 30 means the customer has 30 days to settle their account, net 60 allows for 60 days, etc. Some businesses offer discounts that encourage a customer to settle their account before the net period is over.

What is the most common payment term : The more common payment terms are net 30 and net 60. Net 30 means that the business owner expects payment within 30 days from the invoice date. Net (number of days) is a credit term that means a business delivered a product or service first in expectation of receiving compensation at the stated date.

What are the two types of payment terms : Cash on Delivery (COD) – Also known as Payable on Receipt or Immediate Payment, this simply means that payment is due when the project is delivered to the client. Line of Credit (LOC) – This lets the customer make a purchase on credit, settling bills in instalments over time.

Why use payment terms

Establishing clear payment terms on invoices can help small businesses project and manage cashflow, as well as manage customer expectations. Detailed invoices reduce the risk of misunderstandings between businesses and customers.

An example of this format in use is “5% 10, net 30”, where the seller is offering a 5% discount to the buyer if they pay in full (in this case, 95% of the invoice amount) within 10 days of the goods or services being delivered. If they take longer than 10 days to pay, they lose the discount.An invoice with net 15 terms means that a customer has 15 days to pay their invoice in full. Typically, the payment is due 15 days from the date that you send an invoice (when invoicing digitally), or 15 days from the date the buyer received the invoice (when the invoice is sent by mail).

What is a 40 30 30 payment term : Standard “Progress Invoicing” terms are 40/30/30 (3 payments) – 40% Invoiced Upon Design/Drawing Approval, Due Net 15 Days (Invoice Upon Receipt of Order if No Drawing Approval is required); 30% Invoiced 30 Days Prior to Shipment, Due Prior to Shipment; 30% Invoiced at Shipment, Due Net 30 Days.