Antwort What are the 4 types of sanctions? Weitere Antworten – What are the different types of sanction

There are several types of sanctions.

- Economic sanctions – typically a ban on trade, possibly limited to certain sectors such as armaments, or with certain exceptions (such as food and medicine)

- Diplomatic sanctions – the reduction or removal of diplomatic ties, such as embassies.

Economic and trade sanctions are some of the most commonly applied sanctions. But economic sanctions can take many forms, depending on what the sanctioning nation tries to achieve. Embargoes: Bans trade with a specific country.It is an Anti-Money Laundering (AML) control. Ultimately, sanctions screening is a tool intended to disrupt financial crime as well as both detect and prevent it. Sanctions screening can restrict trade with specific individuals, groups, agencies, and individuals in a number of industries.

Who can issue sanctions : At present there are three main authorities imposing sanctions: the United Nations, the European Union and the Organisation for Security and Cooperation in Europe (OSCE).

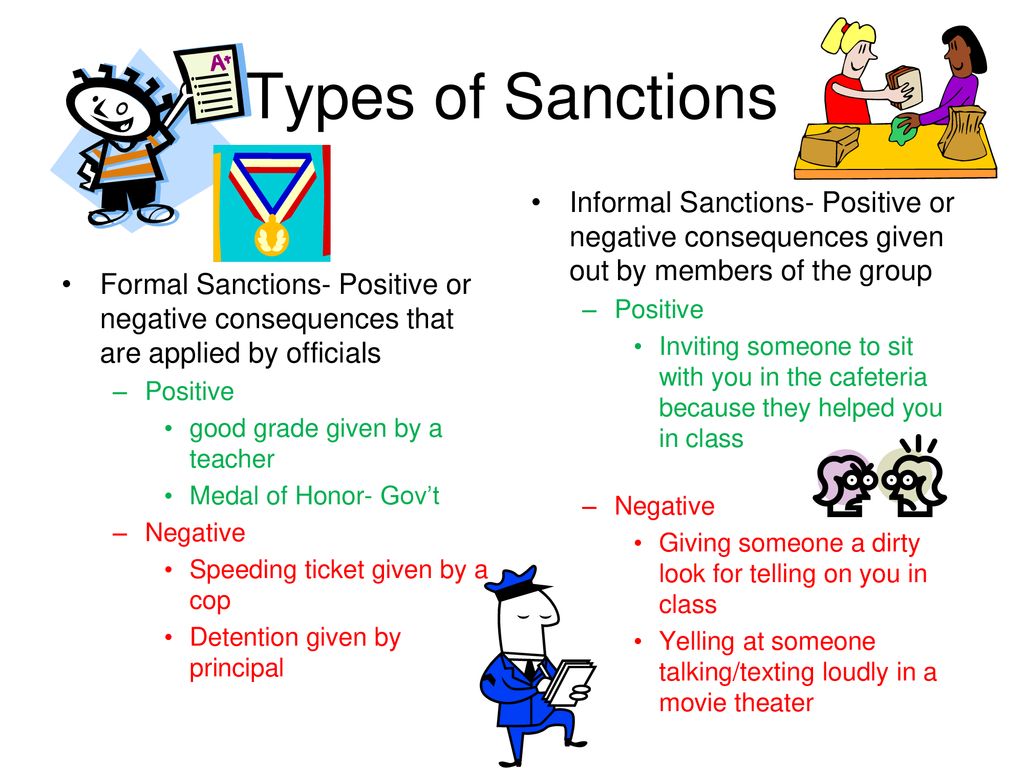

What are 3 formal sanctions

Some formal sanctions include fines and incarceration in order to deter negative behavior. Other forms of formal social control can include other sanctions that are more severe depending on the behavior seen as negative such as censorship, expulsion, and limits on political freedom. Examples of this can be seen in law.

What are 2 types of sanctions : The sanctions can be either comprehensive or selective, using the blocking of assets and trade restrictions to accomplish foreign policy and national security goals.

Types of sanctions

- Arms and related materials embargo.

- Asset freeze.

- Export and import restrictions.

- Financial prohibitions.

- Technical assistance prohibitions.

- Related measures.

Sanctions are tools used by countries or international organizations to impose restrictions on certain activities or relations with specific regions, entities, or individuals. They are typically employed to address threats to national security or international peace, human rights abuses, and prohibit illicit activity.

Who controls sanctions

The Office of Foreign Assets Control ("OFAC") of the US Department of the Treasury administers and enforces economic and trade sanctions based on US foreign policy and national security goals against targeted foreign countries and regimes, terrorists, international narcotics traffickers, those engaged in activities …The Office of Economic Sanctions Policy and Implementation (EB/TFS/SPI) is responsible for developing and implementing foreign policy-related sanctions adopted to counter threats to national security posed by particular activities and countries.Sanctions measures can include: • Restrictions on trade in goods and services • Restrictions on engaging in commercial activities • Targeted financial sanctions (including asset freezes) on designated persons and entities • Travel bans on certain persons.

Economic sanctions include travel bans, export restrictions, trade embargoes, and asset seizures. Sanctions can be imposed unilaterally by a single country or multilaterally by a group of countries or an international organization. The penalties can be levied against a country, its officials, or private citizens.

What are the three 3 components of KYC : The 3 components of KYC.

- Customer Identification Program (CIP)

- Customer Due Diligence (CDD)

- Ongoing Monitoring.

What is red flag in AML : In Anti-Money Laundering (AML) compliance, a red flag describes a warning sign that indicates the possibility of money laundering or other criminal activity. Red flags can include transactions involving companies in sanctioned jurisdictions, large volumes, or funds being transmitted from unknown or opaque sources.

How do sanctions work

Trade sanctions can include import controls for specific countries, regions, or industries. Assets within sanctioning jurisdictions can be seized or frozen, preventing their sale or withdrawal. Officials, private citizens, and immediate family members may be denied travel access to sanctioning jurisdictions.

Sanctions implementation is shared across the executive branch, primarily among the Department of State, Treasury (through OFAC), the Department of Commerce, and the Department of Justice (DOJ).The five stages of KYC – customer identification, customer due diligence, risk assessment, ongoing monitoring, and reporting suspicious activities – are essential to ensure compliance with regulatory requirements.

What are the 4 pillars of KYC : The four pillars, or four KYC elements, that banks and financial institutions look at when setting up their KYC programs are the customer acceptance policies and procedures, customer identification program and customer due diligence, risk management, and ongoing monitoring.

:max_bytes(150000):strip_icc()/embargo.asp-final-dc4b1a09a0ca42cf9480301b938f9987.png)