Antwort What is VAT ID in Europe? Weitere Antworten – What is a VAT ID number in Europe

European Union VAT identification numbers. 'BE' + 8 digits + 2 check digits – e.g. BE09999999XX. As of recent changes, numbers starting with '1' are now issued. Note that the old numbering schema only had 9 characters, separated with dots (e.g. 999.999.The VAT number (Umsatzsteuer-Id)

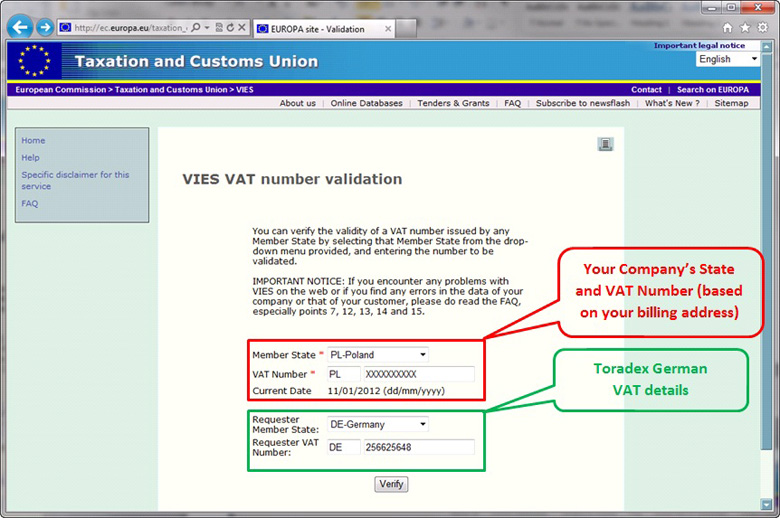

The Umsatzsteuer-ID is the German VAT number. It's a 9 digit number with the format “DE123456789”. It's also called Umsatzsteuer-Identifikationsnummer, USt-Identifikationsnummer or USt-IdNr. The tax VAT number is for businesses that charge VAT.How do I check an EU VAT number To check your own VAT number or the VAT number of another business, you can use VIES. VIES is a tool developed by the European Commission to confirm the validity of VAT numbers across the EU.

What is my VAT ID : Where Can I Find a VAT Number A business can find their own number on the VAT registration certificate that they will have been issued by HMRC. If you're looking for the VAT code of another business, it should appear on any custom invoice that has been supplied to you.

Is VAT number same as tax ID in Germany

The Steuernummer is the tax number issued by the tax office where the business is registered. It is used in VAT returns and for all correspondence, audits, and day-a-day issues with the tax authorities. The VAT ID number, often referred as USt-IdNr, is the VIES number, used for all intra-Community transactions.

How do I find the VAT number of a company name : When searching for a business's VAT number, first check the company's website, invoices, tax documents, or VAT registration certificate. If still not found, search government databases like the EU's VAT Information Exchange System. As a last resort, directly contact the business's tax department.

A Steuernummer is your German freelance tax number. Steuernummer is assigned to self-employed people in Germany. Every self-employed person will have a Steuer-ID AND a Steuernummer. A German freelance tax number comes in a XX/XXX/XXXXX format.

VAT NUMBER (UMSATZSTEUER)

As an individual freelancing in Germany, you may be required to obtain a VAT number (in German: Umsatzsteuer or USt-IdNr) in order to charge it to your clients and pay it to your tax office (VAT return), unless your yearly revenue is lower than 17.500 EUR.

What happens if I don’t have a VAT number

Individuals or organizations without a VAT number ordering from within the European Union will have to pay 21% VAT. We advise you to check with your administrative or financial department about having a VAT number before placing your order. If you are outside the EU, you do not need a VAT number.You must register if you realise that your annual total VAT taxable turnover is going to go over the £90,000 threshold in the next 30 days. You have to register by the end of that 30-day period. Your effective date of registration is the date you realised, not the date your turnover went over the threshold.Among other things, the VAT number is required for the following cases: the business delivers goods elsewhere in the Community territory (intra-Community supply of goods) the business acquires goods from elsewhere in the Community territory (intra-Community acquisition)

Agents can find their Agent Government Gateway identifier by logging on to HMRC online services for agents and selecting 'Authorise client' from the left hand menu. The identifier will appear on the next screen under the title 'Agent identifier'.

Do I need a VAT number in Germany : Businesses are required to register for VAT in Germany when the annual turnover exceeds a certain value. The registration requirements apply to both residents and non-residents, however, reduced rates (as described above), as well as a scheme for small businesses, applies to companies.

What does a VAT number look like : VAT number format

In England, Scotland, and Wales, a VAT number consists of the letters 'GB' followed by nine numbers. An example of a VRN that follows the UK VAT number format could be 'GB123456789'. If your business is located in Northern Ireland and you trade to the EU, you will use the prefix “XI” instead of GB.

Do freelancers need a VAT number in Germany

VAT NUMBER (UMSATZSTEUER)

As an individual freelancing in Germany, you may be required to obtain a VAT number (in German: Umsatzsteuer or USt-IdNr) in order to charge it to your clients and pay it to your tax office (VAT return), unless your yearly revenue is lower than 17.500 EUR.

Typical instances where a foreign trader is required to register for a local VAT number include: If a foreign company is buying and selling goods in another country. If a company is importing goods into an EU country, which can include moving goods across national borders within the EU.A non-VAT invoice does not need to detail applicable VAT amounts and should not show a VAT registration number. While many business owners keep digital records of their VAT invoices, this is not required for invoices without VAT. Input VAT cannot be claimed from an invoice without VAT.

Who needs to register for EU VAT : Typical instances where a foreign trader is required to register for a local VAT number include: If a foreign company is buying and selling goods in another country. If a company is importing goods into an EU country, which can include moving goods across national borders within the EU.