Antwort Which are the international accounting standards? Weitere Antworten – What are the International Accounting Standards

International Accounting Standards (IAS) are a set of rules for financial statements that were replaced in 2001 by International Financial Reporting Standards (IFRS) and have subsequently been adopted by most major financial markets around the world.Summary. IAS represents International Accounting Standards, while IFRS alludes to International Financial Reporting Standards. The IAS Standards come between 1973 and 2001, while IFRS guidelines come from 2001 onwards. IAS Standards fall under the IASC, while the IFRS come via the IASB, which succeeded the IASC.The IFRS Foundation publishes 17 standards that apply to different aspects of accounting: IFRS 1: First-time adoption of international financial reporting standards.

Is international GAAP and IFRS the same : The primary difference between the two systems is that GAAP is rules-based and IFRS is principles-based. This difference appears in specific details and interpretations. IFRS guidelines provide much less overall detail than GAAP.

What is 17 international accounting standard

IAS 17 sets out the required accounting treatments and disclosures for finance and operating leases by both lessors and lessees, except where IAS 40 is applied to investment property held by a lessee. A finance lease – a lease that transfers substantially all the risks and reward of ownership.

Is GAAP an international standard : International Financial Reporting Standards (IFRS) – as the name implies – is an international standard developed by the International Accounting Standards Board (IASB). U.S. Generally Accepted Accounting Principles (GAAP) is only used in the United States.

UK domestic law permits optional application of UK-adopted international accounting standards for all companies (except those that are charities) whose securities do not trade in a regulated market. UK-adopted international accounting standards are IFRS Standards as issued by the Board with some limited modifications.

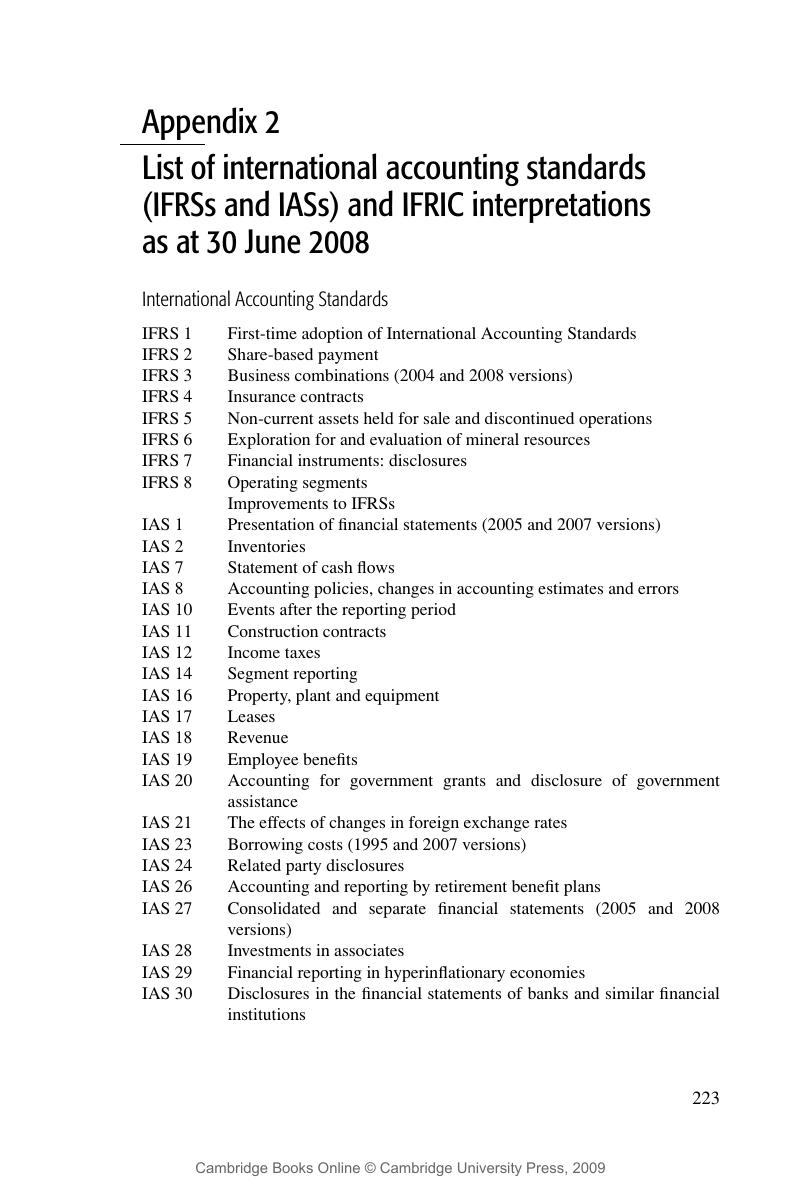

List of IFRS Standards

| IFRS # | IFRS Standard |

|---|---|

| 1 | First-time Adoption of International Financial Reporting Standards |

| 2 | Share-based Payment |

| 3 | Business Combinations |

| 4 | Insurance Contracts |

What are the 32 accounting standards

Indian Accounting Standards (Ind AS) list

| Accounting standard | Use |

|---|---|

| Ind AS 27 | Consolidated and Separate Financial Statements |

| Ind AS 28 | Investments in Associates and Joint Ventures |

| Ind AS 29 | Financial Reporting in Hyperinflationary Economies |

| Ind AS 32 | Financial Instruments: Presentation |

In addition, even if the overall approach taken in the guidance is similar, there can be differences in the detailed application, which could have a material impact on the financial statements. IFRS guidance is currently comprised of 38 standards and 26 interpretations.IFRS is used in more than 110 countries around the world, including the EU and many Asian and South American countries. GAAP, on the other hand, is only used in the United States. Companies that operate in the U.S. and overseas may have more complexities in their accounting.

The key difference between IAS and IFRS is that IAS is the earlier version of the accounting standards, while IFRS is a more up-to-date and widely used version worldwide. IFRS provides more detailed requirements for financial reporting and covers a broader range of accounting issues than IAS.

What is the 27 accounting standard : As per Ind AS 27, when an entity prepares separate financial statements, it shall account for investments in subsidiaries, joint ventures and associates either at cost, or Fair value as per Ind AS 109. Further, the entity shall apply the same accounting for each category of investments.

What are 21 accounting standards : The objective of this Standard is to lay down principles and procedures for preparation and presentation of consolidated financial statements. Consolidated financial statements are presented by a parent (also known as holding enterprise) to provide financial information about the economic activities of its group.

What is difference between IFRS and IAS and GAAP

IFRS is a principle of the standard-based approach and is used internationally, while GAAP is a rule-based system compiled in the U.S. The IASB does not set GAAP, nor does it have any legal authority over GAAP.

GAAP tends to be more rules-based, while IFRS tends to be more principles-based. Under GAAP, companies may have industry-specific rules and guidelines to follow, while IFRS has principles that require judgment and interpretation to determine how they are to be applied in a given situation.Under UK GAAP, derivatives are usually stated initially at historical cost (often £ nil). IAS 39 requires fair value accounting with all gains and losses recognised in the profit and loss account (unless cash flow hedge accounting is applicable).

Is UK GAAP and IFRS the same : One key difference between IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles) lies in the treatment of inventory valuation methods, with IFRS allowing the use of LIFO (Last In, First Out), while GAAP does not permit it.

:max_bytes(150000):strip_icc()/ias_final-2b17eeac83cf48cebe03008573574aed.png)